Boi Reporting 2025 Florida Reporting

Boi Reporting 2025 Florida Reporting. The following materials are now available on fincen’s beneficial ownership information reporting webpage, www.fincen.gov/boi: For example, in response to.

The corporate transparency act requires many businesses to file data about their beneficial owners by jan. As a reminder, the clock is ticking for u.s.

New Business Owner Reporting 2025 BOI Reporting Requirements YouTube, A recent ruling in a federal district court has changed the corporate transparency act’s (cta) beneficial ownership information (boi) reporting requirements for some, but not.

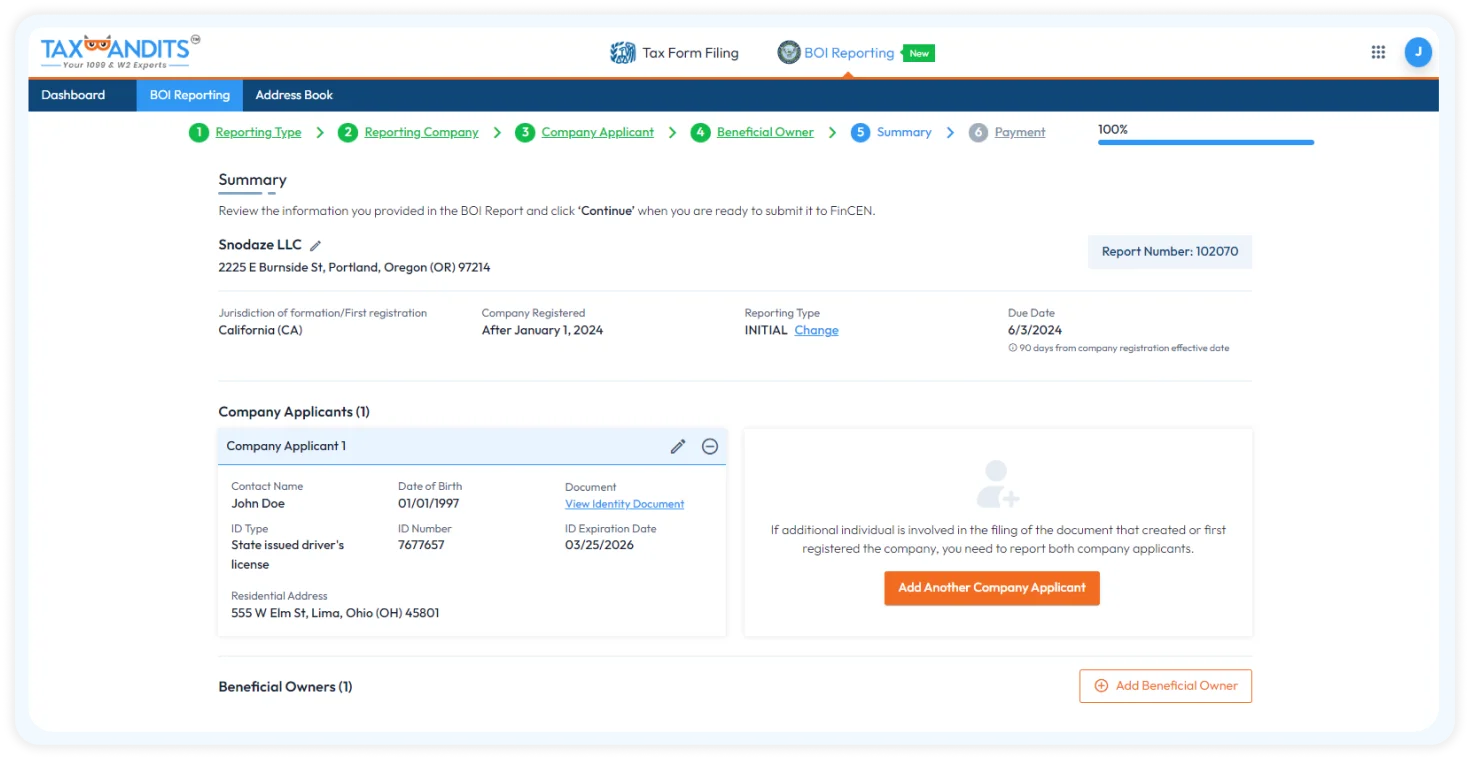

BOI Filing How to File BOI Report Online for 2025, Fincen boi reporting, effective 01/01/2025, now wants most domestic entities to report their ownership or face $10,000 in fines and possible jail time.

BOI Reporting Regulations Effective January 2025 Cherry Bekaert, Rutledge of stoll keenon ogen pllc, even with all that is going on fincen should continue.

Boi Filing 2025 Florida Statute Bria Beatrice, As suggested by the national guru of boi reporting, kentucky attorney thomas e.

The Corporate Transparency Act Navigating BOI Reporting in 2025 By, Protect yourself from costly penalties by ensuring compliance with the corporate transparency act and fincen’s boi reporting requirements.

FINCEN BOI Reporting Tax1099 Blog, Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s (cta) beneficial ownership.

BOI Reporting New for 2025 The Boom Post, As we’ve communicated across our ficpa platforms for months, the corporate transparency act (cta) mandates that entities now must report their beneficial ownership.

2025 BOI Reporting Navigating Requirements for Your Business YouTube, The boi reporting form will be available on fincen’s website starting january 1, 2025.

Demystifying new BOI Reporting for 2025 A NoSweat Guide for Business, A reporting company created or registered to do business before january 1, 2025, will have until january 1, 2025 to file its initial beneficial ownership information report.